Earn additional income

Manage expenses

Protect against loss of income

Protect family assets

Consolidate debt

Strive to eliminate debt

•Reduce taxation

Build a family legacy

Save at least 3-6 months’ income Prepare for unexpected expenses

Reduce taxation

Build a family legacy

Age, health, debts, dependents, income and a variety of

other factors should all be considered.

However, the basic rule of thumb is approximately 10x your

annual family income.

A Broken Traditional Retirement Model

Past retirees often enjoyed a combination of a company

pension, Canadian Pension Plan, and their personal savings.

With this traditional model all but gone, a new retirement

strategy focused on personal responsibility is needed.

Time: Your worst enemy or greatest ally

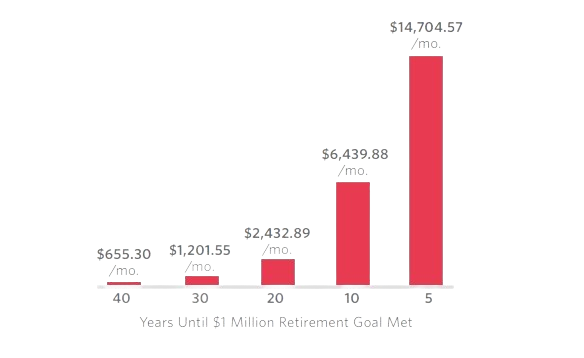

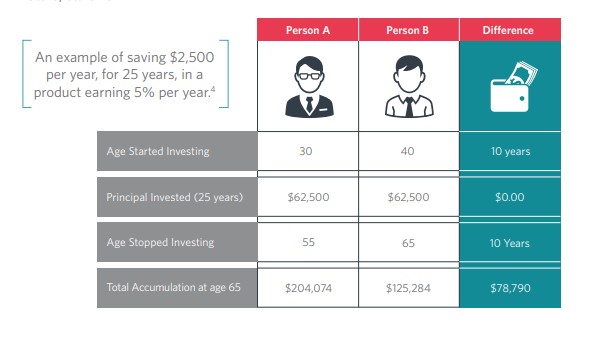

Here is a hypothetical example of how the monthly amount required to reach $1 million for retirement changes with how much time you have to hit that goal in an 5% tax-deferred account.

The best way to put time on your side is to start saving today.

Time can be your greatest ally or your worst enemy. If you haven’t started saving for your future, start now.

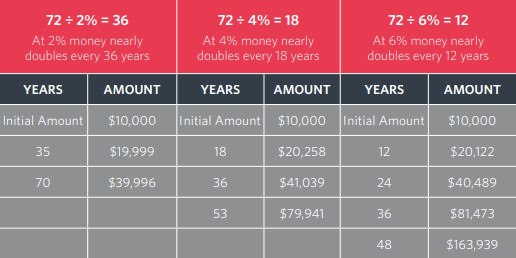

Divide 72 by an annual interest rate to calculate approximately how many years it takes for money to double assuming the interest is compounded annually. Keep in mind that this is just a mathematical concept. Interest rates will fluctuate over time, so the period in which money can double cannot be determined with certainty.

Additionally, this hypothetical example does not reflect any taxes, expenses, or fees associated with any specific product. If these costs were reflected the amounts shown would be lower and the time to double would be longer.

Notice how a $5,000 investment at age 29 doubles more often as the rate of return increases.

That’s exciting to think about, but consider the interest rate on your credit card.

Is it 18%? Higher? The Rule of 72 can work against you just as powerfully as it can work for you. Debt management is still important.

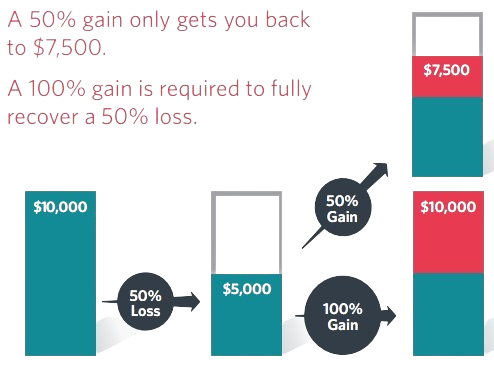

It hurts more than you think.If you lose 50% of $10,000, what rate of return does it take to get back to $10,000?

A 50% gain only gets you back to $7,500. A 100% gain is required to fully recover a 50% loss.

Which one is right for you?

Stay informed on the latest financial strategies and insights. Subscribe to our newsletter!

Set up and designed by Pivotal Workforce Solutions Inc

Copyright © 2024. All rights reserved.